5 Best Recurly Alternatives 2022: No Limit On Billing & Invoicing

Whether you are the stand-alone buyer, integrated system buyer or highly unique buyer, looking for the Recurly alternatives then this blog is definitely a sight of your sore eyes!

We have come up with the precise comparison of Recurly with its alternatives. These clear-cut comparisons of Recurly help you to select the right replacement under no illusion.

Have A Look At Some Recurly Alternatives

| Service | Price(Month) | Dunning Management | One-Time Payments | Unlimited Revenue |

| Pabbly Subscriptions | $19.00 | ✔ | ✔ | ✔ |

| Zuora | Contact Sales | ✔ | ✔ | ✖ |

| Chargebee | $99.00 | ✔ | ✔ | ✖ |

| PaySimple | $49.95 | ✔ | ✔ | ✖ |

| Braintree | 2.9% + $.30 Per Transaction | ✖ | ✔ | ✖ |

Instead of beating around the bush, you will get the better of one on the basis of online payment software, time tracking, creating & sending invoices, reporting and integration ability for your business.

Let the cat out of the bag!

Pabbly Subscriptions Vs Recurly: Unlimited Billing & Invoicing

Pabbly Subscriptions is the smartest subscription management and recurring billing software that has grabbed the market attention nowadays. As compared to Recurly, Pabbly Subscriptions is grist to the mill. Through it, you can create unlimited subscriptions for your customers in a couple of minutes.

Pricing:

- Pabbly Subscriptions has a Starters plan which costs $5/m for up to 50 customers. Also, you will be able to setup unlimited products and plans with so much ease.

- It also has a Rookie plan charging $29/m which is best for up to 1000 customers.

- The Pro plan of this tool costs $59 per month in which you will be able to do various things of unlimited customers.

- It has an Advance plan best for big businesses charging $99/m. Through it, you can have the access of custom domain functionality & the affiliate system too.

Features:

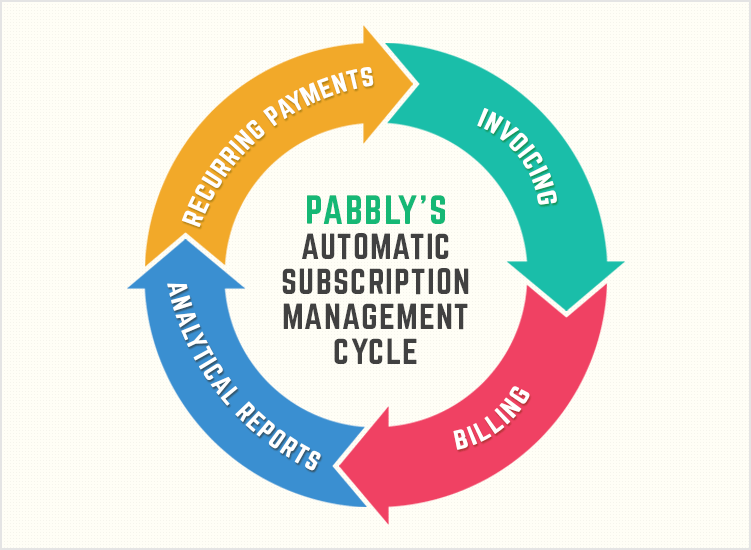

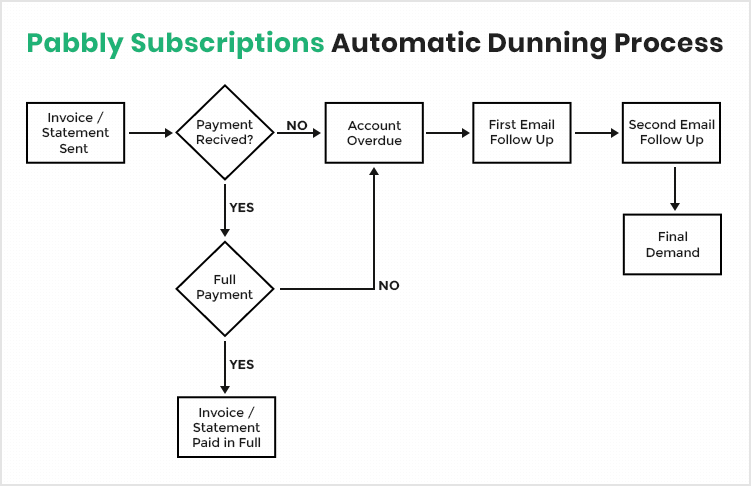

- The online and billing automation software of Pabbly Subscriptions has completely replaced manual work organization of subscription business. As illustrated below in the work management cycle of this tool:

- While it is managing your overall subscription process, it also keeps an eye on the declined payments.

- Its automatic dunning management tool:

– Alerts your subscriber for their monthly recurring payments.

– Notifies your subscriber for all the failed payments.

– Pabbly Subscriptions is a camp follower of your business. It constantly reminds clients for payment.

– This tool always tries to be safe than sorry, therefore it informs the customers if their credit card is going to expire to avoid payment failure.

- Pabbly Subscriptions can create unlimited products as well as you can add some salt to your business by creating a beautiful sales funnel for upselling and downsell products.

- Collect recurring payments automatically according to the specified pre-scheduled time. Generate professional invoices and bills spontaneously. Develop analytical reports having information for active customers, new subscribers, MRR, net revenue etc.

- For more information, you can watch this video of Pabbly Subscriptions.

Visit Pabbly Subscriptions Now

Chargebee Vs Recurly

Chargebee is another Recurly alternative after Pabbly Subscriptions. In terms of working both are on the same page. However, there are some pitfalls in Chargebee too but it is ahead of the game.

However, the pricing of Chargebee will cost you an arm and a leg. Maybe you will feel the pinch after using Chargebee in place of Pabbly Subscriptions!

Let’s clear the air!

Pricing:

- In reference to the Chargebee with Recurly, I’d probably say “I’ve got an itchy tapping-hand”. Pricing of Chargebee is $599/month and an additional revenue share.

Features:

- Chargbee is providing a perk of tax settings in which the user can configure taxes on the service, sales, and invoices. Recurly does not have this technique.

- As compared to Recurly, Chargebee is providing multiple billing options like the creation of advance invoices, application of excess payments, write-off invoices etc.

- You can create invoices, bills, hosted pages, emails in many languages which Recurly is not allowing to do.

- Chargebee allows keeping track of itsy-bitsy details by creating categories based on customers, plans, subscriptions and credit notes. Recurly does not have this special feature. Chargebee acts as a complete finance book for a company.

Zuora Vs Recurly

Zuora and Recurly, both applications are next to each other. However, Zuora is much easier to use than Recurly. The top-notch specialty of Zuora is its multiple dynamic subscription pricing models.

Let’s analyze closely:

Pricing:

- Recurly provides three pricing models of different prices. Whereas Zuora has 40+ pricing models. The charges are based on the preferred model.

Features:

- Zuora is integrated with 6+ business systems and applications whereas Recurly is integrated with only 4 platforms Webhooks, MailChimp Integration, User Roles and Salesforce.

- Zuora is supporting 200+ currencies globally, this multilingual trait of Zuora makes it the sharpest tool in the shed. Recurly supports only 21 currencies worldwide.

- Recurly is good for large enterprises and medium business requirements. However, Zuora is splendid for modest business requirements and freelancers.

Recurly Vs Paysimple

PaySimple is another preferred SaaS-based online payment software than Recurly in the market. If your business is modest & midway than you should choose PaySimple as the best Recurly alternative for your business.

Let me show you the clarity!

Pricing:

- PaySimple is very affordable software to be integrated with your subscription business. Its cost started at just $49.95 on monthly basis. However, Recurly is very costly as compared to PaySimple.

Features:

- PaySimple has very good compatibility with the web, iPhone, and Android app. Where as Recurly is the only web-based. You can carry this beautiful platform with your business mobile app. This flexibility is not available in Recurly. However, PaySimple also has some loopholes like its long checkout timings but we can’t ignore the good ones.

Note: Recurly and PaySimple services are aiming at different company size. You should pay attention to your company size before selecting between the two. One should not pay for extra features of no use.

Braintree vs Recurly

Braintree is itself a payment gateway however it also provides recurring billing feature for the subscription business. Recurly is the subscription management software, not a payment gateway at all.

Let’s catch out some more dissimilarities!

Pricing:

- It has a standard pricing plan of 2.9% + $.30 per transaction.

Features:

- Braintree is commendable for all kind of business size. From small to enterprise level, it is customizable. Recurly is admirable for enterprise solutions.

- Apart from typical subscription business, Braintree is good for accepting donations, accepting payments from the marketplace and contextual commerce. No such features are available at Recurly.

Conclusion

This is our exploration in the direction of Recurly alternatives. They all stand best according to their pricing & features. But I would suggest you choose the cheapest yet best alternative for Recurly which has almost the same features of it.

Even there are some tools mentioned in this article which can allow you to perform unlimited tasks without any restrictions. So choose any of them wisely!